When it comes to payments, I have some unpopular opinions. This post addresses three of them, which pertain to: employee expense reimbursements, surcharges for card payments, and rebates. Also included are some suggestions for organizations.

Read moreCommercial Card Rebates in the U.S.: A Wild Ride

Rebates are not as simple as up and down; there is a bigger question and better option—beyond basis points—that deserve our focus.

Read morePayments to the Card Issuer: Speed Up or Slow Down?

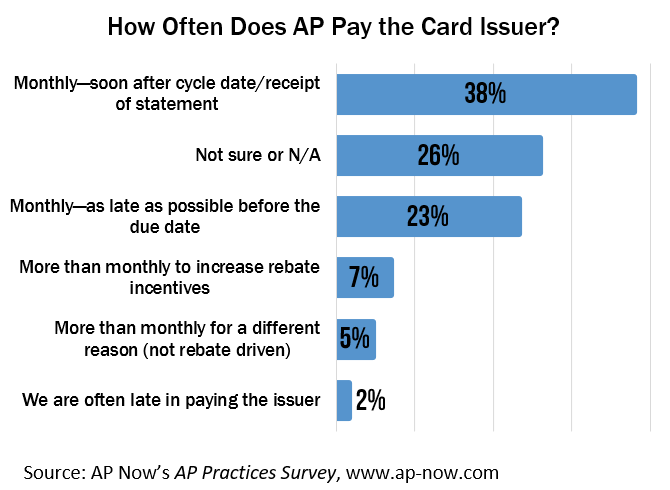

Has your organization made a thoughtful decision about the timing of payments to your card issuer? Does this deserve another look? There is more to it than not being late. For many organizations, revenue share (rebate) incentives are impacted by the speed of pay, also known as file turn. Even if this is not part of your contract, have you worked with your treasury/finance department to evaluate the benefit of paying the issuer quickly against the value of holding on to your cash longer? A recent survey by AP Now reveals the majority of organizations pay their Commercial Card issuer on a monthly basis soon after the cycle ends, but this is not the only option, as shown below. Nearly a quarter of the survey respondents wait as long as possible. Only 7% make payments more than monthly to increase their rebate.

What to Do

While every organization should ensure on-time payments to its card issuer, it is a best practice to identify the ideal timing to support your organization’s needs and goals.

Review your contract to determine if speed of pay/file turn is part of the rebate calculation. If yes, where does your organization stand today? What would your rebate look like if your organization paid the issuer faster or more frequently? Evaluate different scenarios; for example, right after the cycle ends each month, twice per month, weekly, etc. Present your analysis to your management.

Regardless of your rebate incentives, consult with your treasury/finance team to determine the best payment strategy for your organization’s cash flow and overall financial position. Their opinion may also depend on interest rates, which can fluctuate, so it is worthwhile to revisit this topic from time to time.

As an added bonus, having a discussion with treasury/finance might lead to Commercial Card program expansion, such as the adoption of Virtual Cards to help extend float.

My Experience

I was fortunate to have worked for the Federal Reserve Bank. We could pursue the best possible rebate tier for speed of pay since cash flow was not an issue. However, to make this happen, I still had to figure out the right payment timing, which involved various calculations that took into account an average transaction age.

Finally, do not allow payments to your issuer to be delayed by cardholders’ reconciliation of transactions, which should be a separate process. Since your organization is required to pay in full by a certain date, waiting for cardholders to reconcile does not add value. The AP Practices Survey by AP Now shows that, unfortunately, 30% do wait.

Available Products & Services from Recharged Education

- Complimentary online content

- Resources available for purchase

- Fee-based services for industry providers and end-user organizations, such as training, consulting, and content development

Submit a contact form to request a quote for what your organization needs.

Subscribe to the Blog

Receive notice of new blog posts.

About the Author

Blog post author Lynn Larson, CPCP, is the founder of Recharged Education. With 20 years of Commercial Card experience, her mission is to make industry education readily accessible to all. Learn more…