Payment Strategy

Being strategic about which payment methods to use can really pay off. More broadly, your organization should consider the entire purchase-to-pay (P2P) process and determine the best (i.e., least expensive and most efficient) option for various types of purchases; for example:

Recurring bills

Frequent and infrequent purchases/suppliers

Low-value and high-dollar purchases

Contract and off-contract purchases

Purchases initiated through an eProcurement system

Because paper checks are costly, strive to reduce check usage within your organization and increase electronic payments. Implement a mix that best supports internal goals and then turn your strategy into a policy.

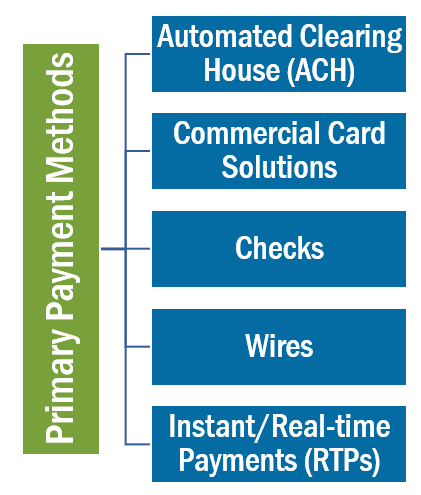

Business-to-Business (B2B) Payments

A new addition to the list below is instant/real-time payments (RTPs), which are becoming more popular.

ACH payments—credit and debit—include “regular” and Same Day ACH.

The primary types of commercial cards include:

Purchasing cards (p-cards)

Corporate travel cards

Fleet cards

Electronic payables/electronic accounts payable (EAP) solutions, including virtual cards

Don't forget to subscribe to the blog (no charge) to receive educational content!