Combatting Surcharges

For additional resources, visit the webpage on surcharging.

Don't forget to subscribe to the blog (no charge) to receive educational content!

Proactive Measures

When you encounter a supplier who struggles with the costs of card acceptance and is contemplating surcharges, consider asking the following questions:

Have you measured the benefits of card acceptance and compared them against the fees?

When was the last time you conducted an RFP for an acquiring/processing partner?

Are you aware you can lower your fees by providing enhanced transaction data (Level III data)?

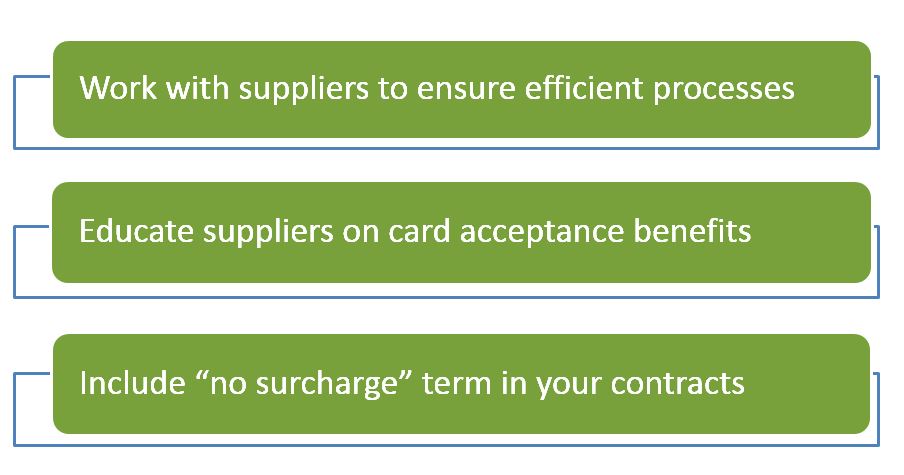

Three proactive measures to take with suppliers

One End-User's Strategy

Recharged Education's Lynn Larson heard from one end-user (a public school district) that found success by changing their terms and conditions to reflect that:

credit cards are the preferred method of payment

the District will not pay any additional fees for credit card payment processing

They also took it a step further to indicate that the District reserves the right to deduct a 5% check processing fee when credit cards are not an available method of payment. This move was strictly intended to address vendors that refuse card payments, even though they are confirmed “card acceptors.” As a result, they converted over 1,100 vendors from checks to card payments.

Questions to Ask Suppliers that Still Want to Surcharge

The following questions pertain to the networks’ (e.g., Visa, Mastercard) requirements related to surcharging. If you need further clarification about the requirements, which are subject to change, please contact your card issuer.

Does the supplier have documentation showing it provided the required notice?

Can their processing partner/software differentiate between a debit and credit card?

Is there notification at the POS, payment page or catalog that the supplier surcharges?

At the time of purchase, is there an opt-out option?

Will/does the receipt show the surcharge amount?

If the supplier meets the requirements, your organization needs to determine how to respond.

Violations

If the supplier imposes a surcharge, but has not met the applicable network’s requirements, contact your card issuer about your options. For example, you might be able to submit some type of merchant violation form.

Generally speaking, the networks routinely look for/audit for violations to merchant card acceptance rules. Non-compliant merchants and/or their acquirers might be assessed a penalty fee.